what does liquidating stock mean

With common stock dividends are not fixed. Liquidating a large portfolio or holdings of significant amounts concentrated in single stocks is a complex task that requires special professional services of a.

Transactions that close or offset a short or long-term position.

. A liquidation specialist at a brokerage firm can help you anticipate the tax consequences when you liquidate stock and advise you about an approach that will maximize. Share price of at least 1. The ideal way for stock to get liquidated is.

Corporate stock as a whole can be liquidated if a company files bankruptcy or if a company is bought out or taken over. Important to note is that only holders of preferred stock receive liquidation preferences. A liquidation that takes place when both the buyers and the sellers of the assets perform the transaction voluntarily.

Investors may choose to liquidate an investment for a variety of reasons including needing the cash wanting to get out of a weak investment or. Stock liquidation which refers to selling stock in a company in exchange for money is something that occurs for various reasons. This calculation is reached by first dividing the return rate of six percent by 12 which.

Liquidating a stock means selling it for cash. You can then use the cash to fund parts of your business such as paying debts or buying new equipment. Liquidation is the selling of assets to raise cash usually to pay off debts.

In the case of a company a voluntary liquidation takes place when the company leadership decides to dissolve the company also referred to as winding-up the company and obtains shareholder approval if needed. Liquidation means the distributions of the Trust Account to the Public Shareholders in connection with the redemption of Ordinary Shares held by the Public Shareholders pursuant to the terms of the Companys Amended and Restated Memorandum and Articles of Association as amended if the Company fails to consummate a Business Combination. Any remaining assets may be distributed to the companys owners.

For example you may be taxed on capital gains or lose the portfolios future appreciation. Lets assume that a preferred stock requires a monthly 025 dividend payment and that there is a six percent required rate of return each year. Another reason for the stock price to collapse and liquidity to dry up is that institutional investors tend to liquidate shares when a company is about to be delisted.

To make it usable stockholders need to sell it ie liquidate it to lock in its value. Liquidating a stock means selling it for cash. Typically those assets are the companys inventory and theyre sold at a deep discount.

Liquidation in most cases is part of closing down or restructuring a business. The liquidation level normally expressed as a percentage is the point that if reached will initiate the automatic closure of existing positions. Liquidity risk is the risk that investors wont find a market.

Any leftovers are then distributed to shareholders. Stocks with low liquidity may be difficult to sell and may cause you to take a bigger loss if you cannot sell the shares when you want to. For example if XYZ stock is trading at 050 then they may issue a 1-for-10 reverse stock split that will result in a 500 share price on the split date.

Purchase in Evening up Offset liquidity. In this scenario the expected value of the stock would be 50. Liquidating a stock means selling it for cash.

Stock liquidation can have a number of different meanings but the common theme is that the stock is sold in exchange for money. A stocks liquidity generally refers to how rapidly shares of a stock can be bought or sold without substantially impacting the stock price. When a company goes into liquidation its assets are sold to repay creditors and the business closes down.

This happens when the business of a company is closed. The difference between the two is the. The Nasdaq has three primary requirements to stay in compliance.

A stock liquidation occurs when stock shares are converted into cash. This usually comes about because a company cannot pay its debts when they fall due or when its liabilities exceed its assets. Whenever you liquidate a small portfolio or convert the stock to cash it has financial consequences.

To liquidate means to sell an asset for cash. Put simply liquidation in business refers to the process by which a company that has reached the end of its life is formally closed down and its assets realised converted into cash. The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just try paying for lunch with a share of Johnson Johnson.

In the context of cryptocurrency markets liquidation refers to when an exchange forcefully closes a traders leveraged position due to a. One reason for stock liquidation is if a company files for bankruptcy. When does a stock get delisted.

In most instances stock liquidation occurs when shareholders sell their shares on the open market for ready cash. There are a number of reasons that can cause a stock to be delisted. Typically this refers to selling non-essential pieces of equipment but in the event of insolvency all assets may be.

When you decide to liquidate your assets you are selling those specific assets in exchange for cash or cash equivalents. The assets are sold and the proceeds used to repay creditors. In Stock Market Dictionary.

What Is A Members Voluntary Liquidation And How Can It Help

Etf Closing Down What Now Justetf

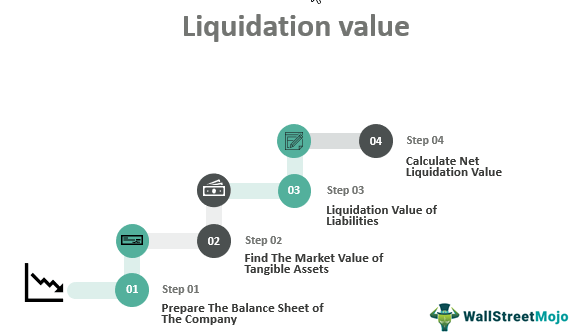

Liquidation Value Formula Example Step By Step Calculation

:fill(white,1)/www.directliquidation.com/contents/uploads/2021/01/Used-merchandise-stores-in-the-US-infographic.png)

Resale 101 How To Start A Liquidation Business Directliquidation

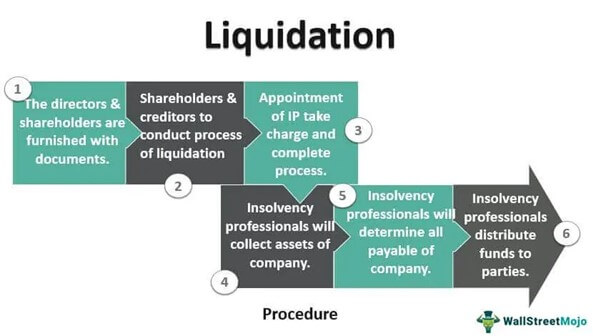

Liquidation Meaning Process Types Examples Consequences

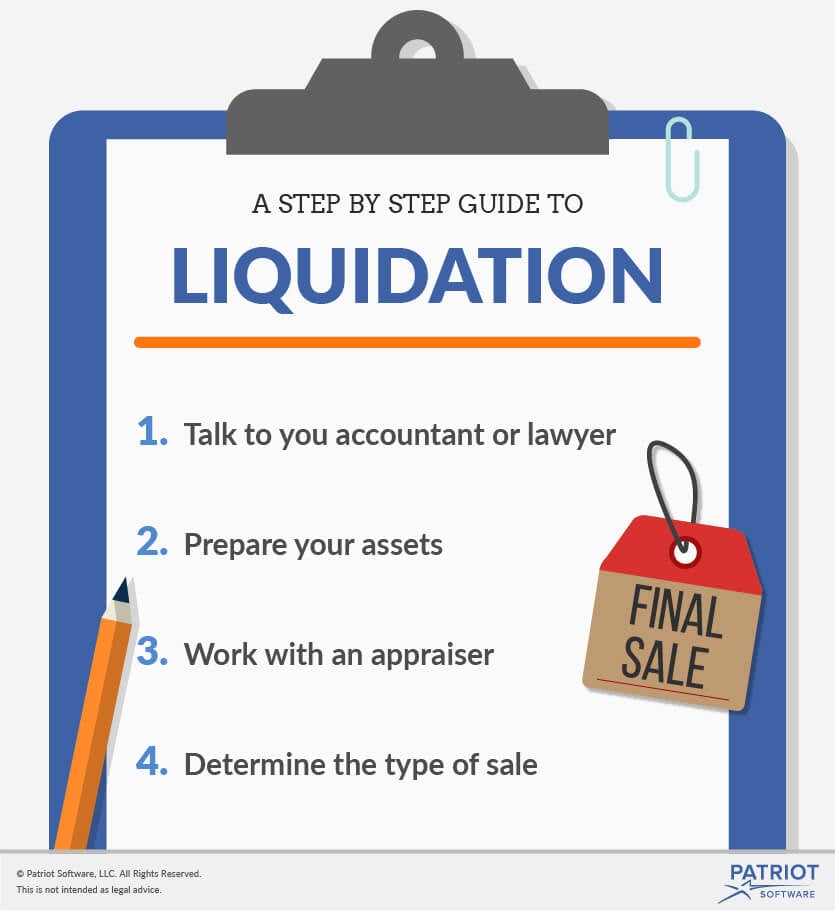

Small Business Liquidation What Is Liquidation In Business

/GettyImages-1064821934-edef6bd98aef40e59a5611816dc745a2.jpg)

What Happens To The Shares Of A Company That Has Been Liquidated

Winding Up Definition And Meaning Market Business News

What Is The Meaning Of Liquidation Definition Of Liquidation

Dissolution Vs Liquidation Of Ltd Company Explained Mint Formations

How To Liquidate Excess Inventory On Amazon Ultimate Guide

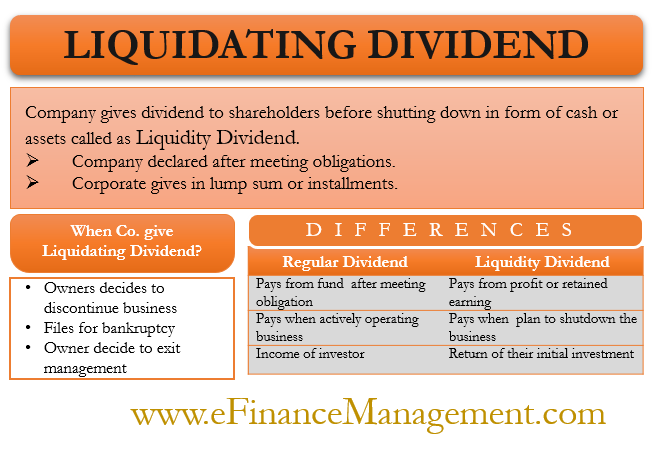

Liquidating Dividend Meaning Example And More

Lifo Liquidation Definition How It Works Why It Occurs

What Happens When A Company Goes Into Liquidation

/liquidation-d53884bd0c01485ba4e6d20385228aa7.jpg)

/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)

/GettyImages-1005470094-d3c3108c195f40f3a1244331105e18f5.jpg)